So I just turned 30. There I said it. I thought I would share some advice for any young people just starting out who might be interested, it might help you avoid some of the mistakes I made.

- Tell the truth

This is the most important thing I’ve learned in my 20s – do not lie. In my experience, nothing brings more anxiety, stress, self-loathing and damage into your life than the lies you tell, to others and also to yourself.

When you are just starting out as an adult you may be tempted to lie for many reasons, to get a job, to be seen to be doing well in that job, to impress your friends and attract a partner. However, every lie will haunt you for the rest of your life, not least because you will need to keep track of to whom you have told which lies to keep the charade going. At any moment you could be exposed as a fraud, and lose all you’ve worked for. Is it worth the risk?

Most lying stems from our insecurities. We lie in the hope that others will think better of us, or give us things; friendship, employment, love, which we believe they would not give if they saw us as we really are. A commitment to telling the truth must therefore start with yourself. You need to accept yourself as exactly who you are right now, the good and the bad, the shadow and the substance, the warp and the woof. If you do that you can go on to do two more things; begin to work on smoothing your rougher edges to become a better you and also become comfortable presenting your true self to the world.

Some practicalities here. Telling the truth does not require that you say whatever comes into your head (‘Hello Sandra, your breasts look fantastic this morning!’). Nor does it require that you answer every question posed to you. It can be perfectly appropriate and truthful to say ‘I’d rather not talk about it’. Secrets are trickier. Whilst it is not lying to keep someone else’s secret for them, it is easy to find yourself in a situation where there is no way to be truthful and keep the secret safe. It may be easiest to adopt some simple rules of thumb which you apply consistently e.g. ‘I don’t discuss my colleagues’ personal lives with other colleagues, you should ask them yourself’ etc.

This is an incredibly hard habit to forge, we are all habitual liars, but this is the one best change I would recommend most people make in their lives. I am still struggling with this, but where I have applied it successfully it has benefited my life no end and where I have failed it has come at great cost to me and done awful damage to other people. If you’d like to read more on this topic, the best primer out there is here.

- Learn about finance and get into the habit of spending significantly less than you earn

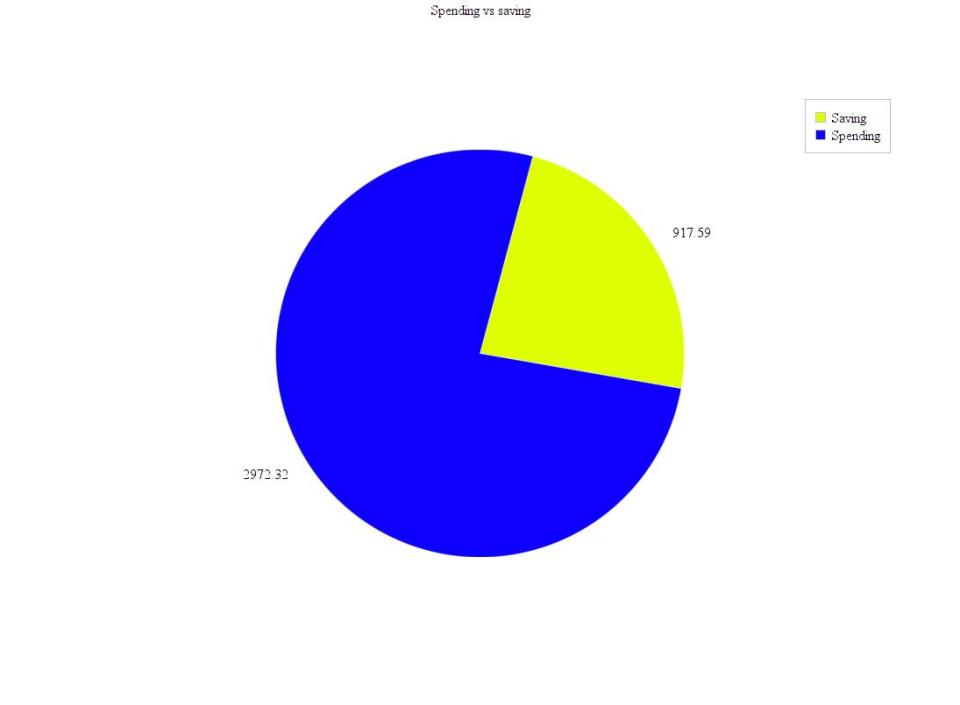

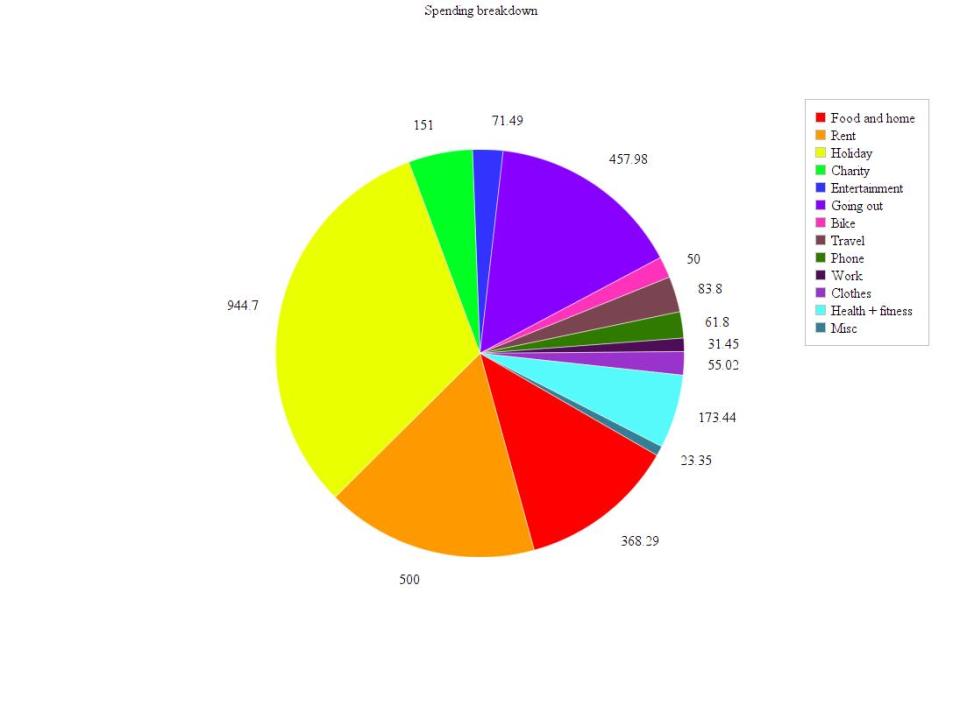

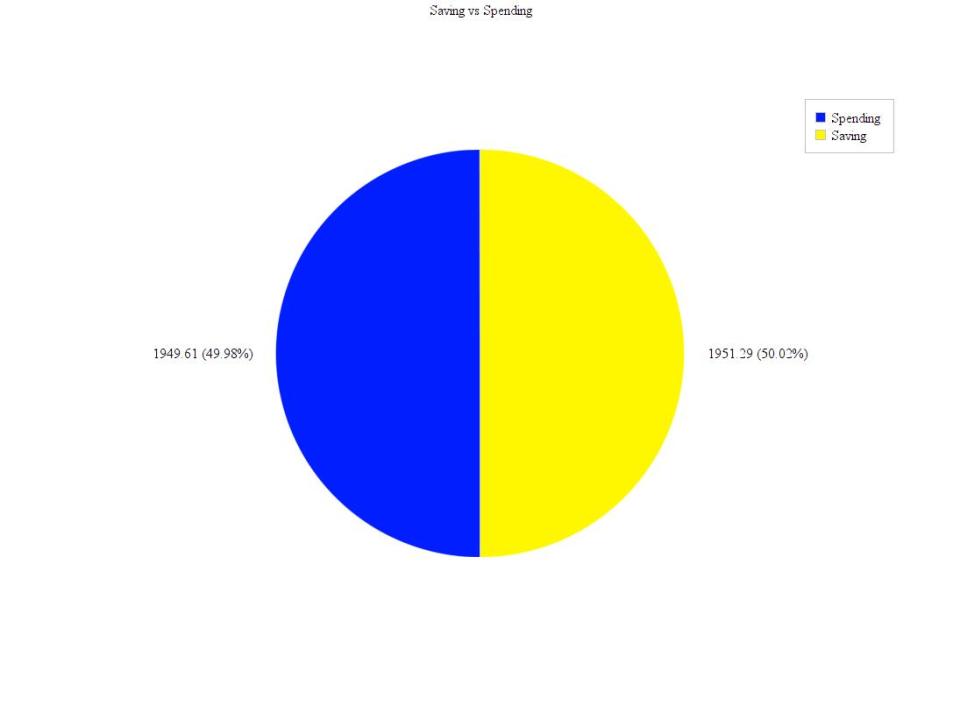

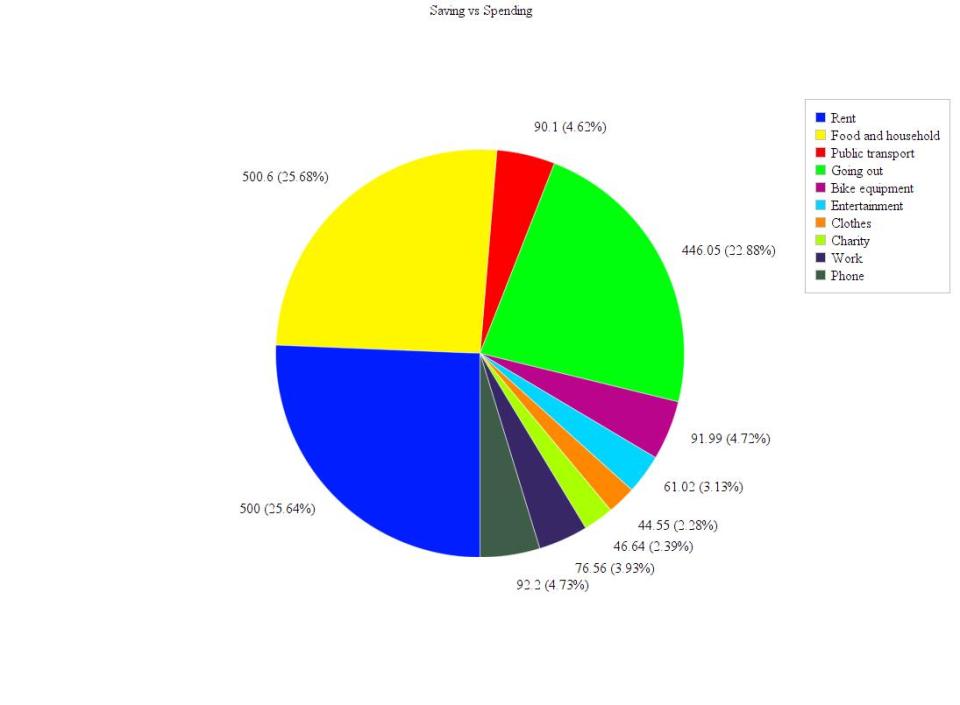

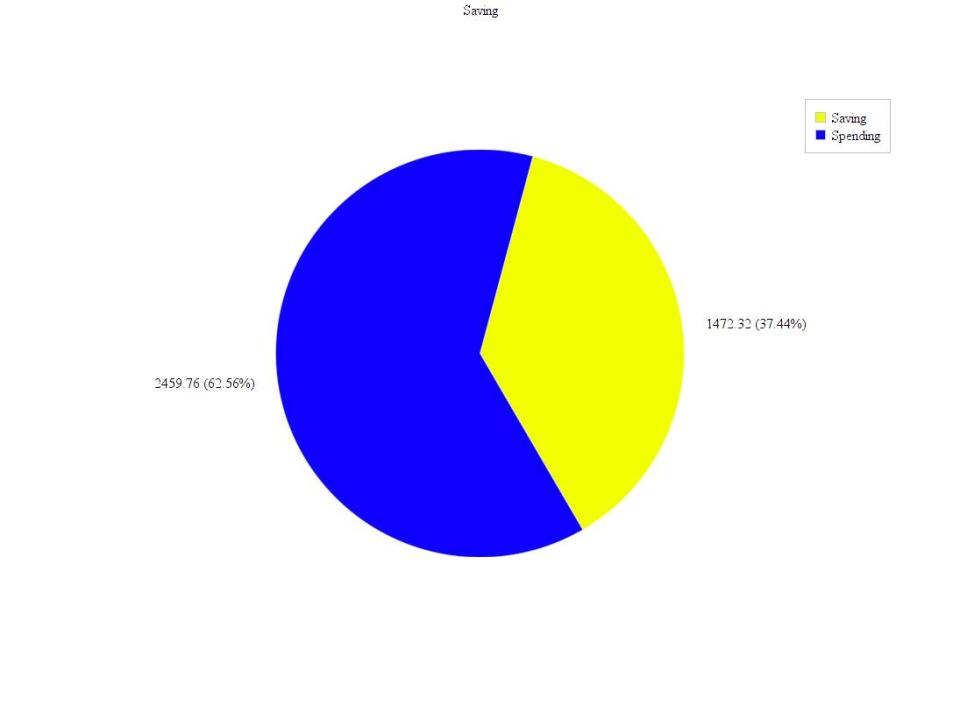

This one won’t come as a surprise to anyone who has read my previous posts. Your 20s are the ideal time to understand how money works and why so many people suck at it. If you work hard and have some good luck you will hopefully move significantly up the earnings ladder in you 20s. While your friends fritter away their money on lavish nights out, ludicrous cars and other status symbols you can begin laying the foundations for a secure financial future which your older self will profusely thank you for. And I’m not talking about just getting the maximum employer match into your pension here, by the end of your 20s you should, depending on your earning level, be saving 25-65% of your take home pay.

It has become the norm in our society for people to spend their entire take home pay each month, saving a bare minimum or not at all. The most important thing you can understand about finance is that this is a bullshit social construct that has no bearing reality of living life in your 20s! You can actively control how much you spend to an incredible degree if you challenge society’s assumptions about what is normal behaviour.

Let’s take an example. A newly minted graduate gal and guy move to London together to start their careers in any of the weird service sector industries the UK specialises in now. Their starting salaries happen to be the UK average of £27,600.

Now conventional wisdom will tell you that there is no way you could save any significant portion of this low (for London) income in this ridiculously expensive city. They’ll never be able to afford the £15,000 for a 5% deposit on their £300K starter house in their 20s.

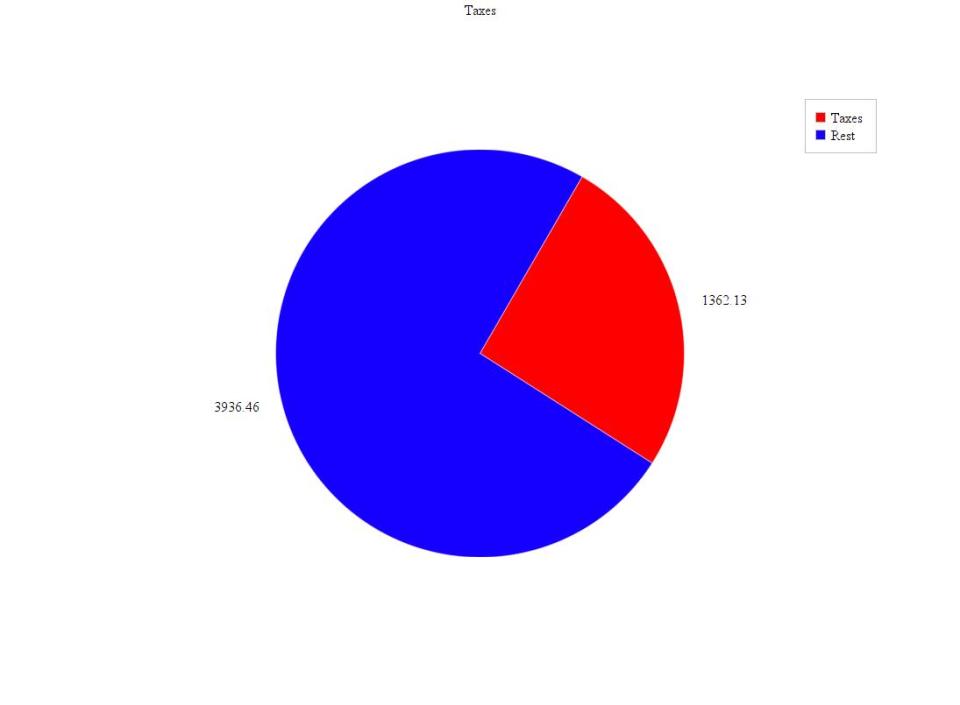

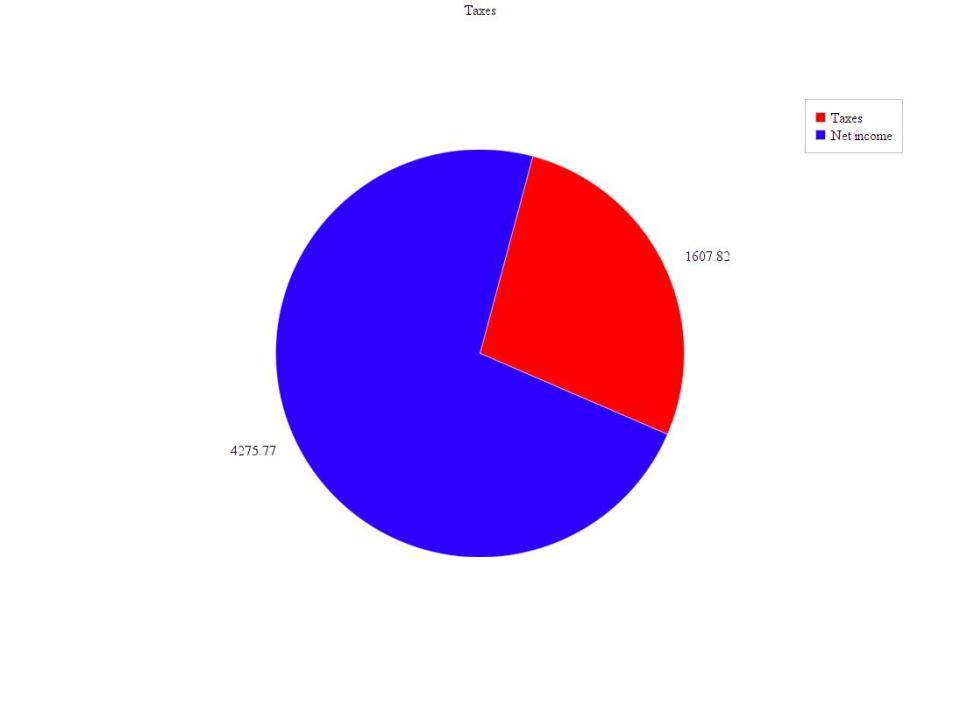

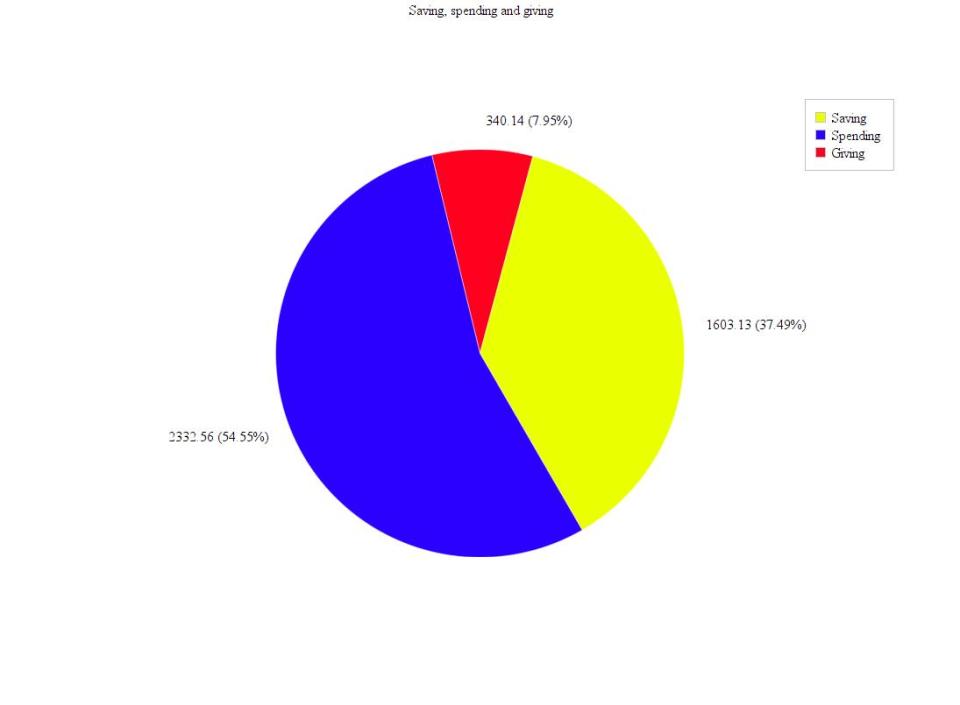

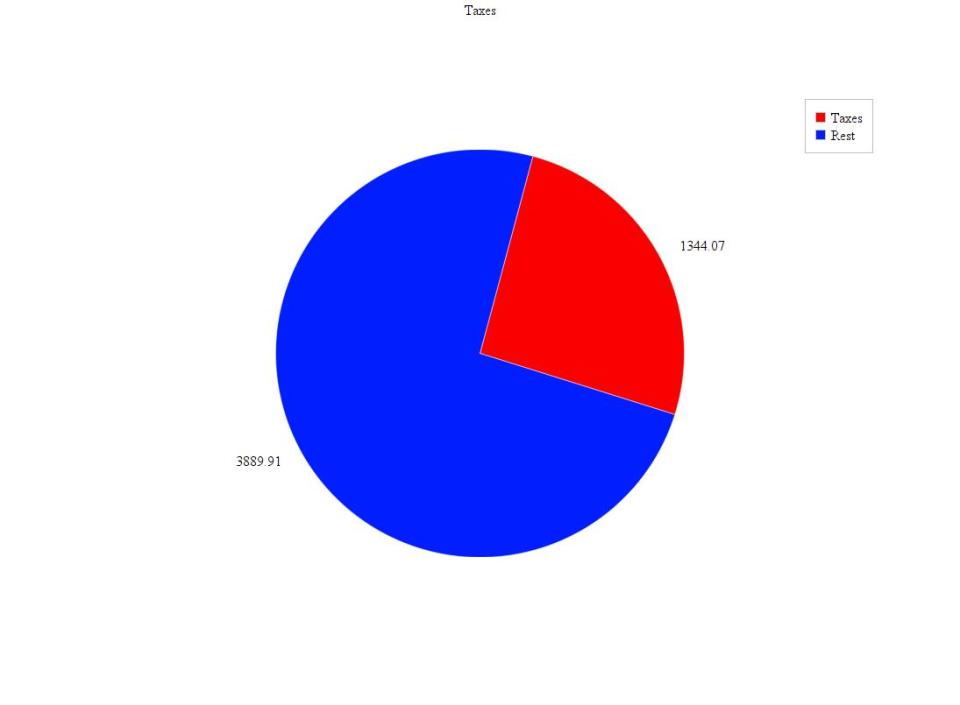

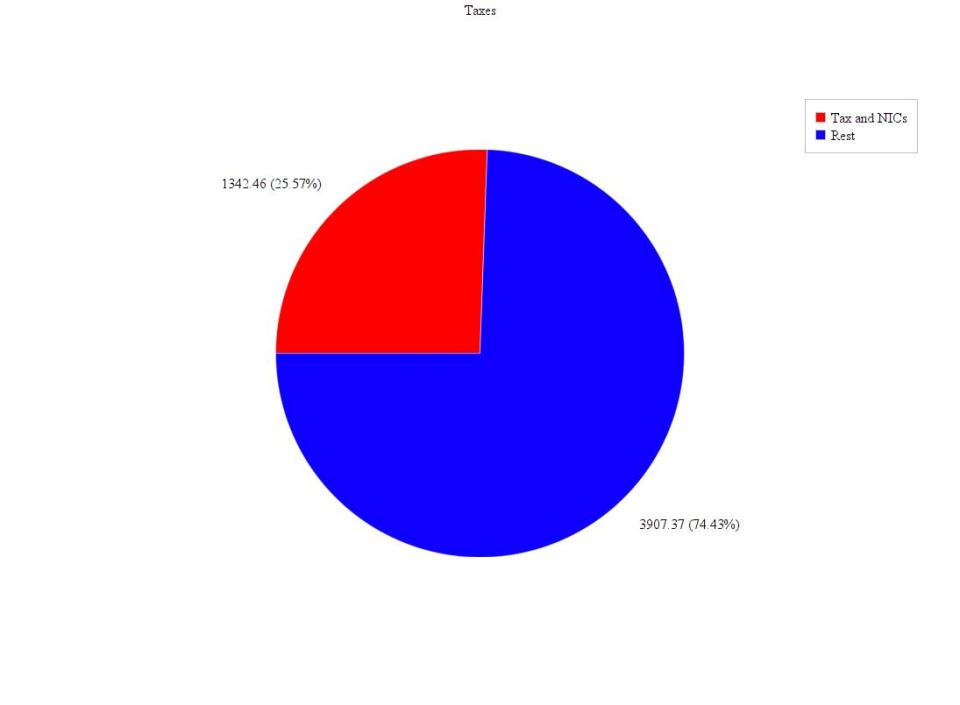

Factoring student loan repayments and a 4% contribution to the company pension, the couple will bring home £1,680.05 net each every month. If they’re willing to be smart with their money, this is what their individual monthly expenses could look like;

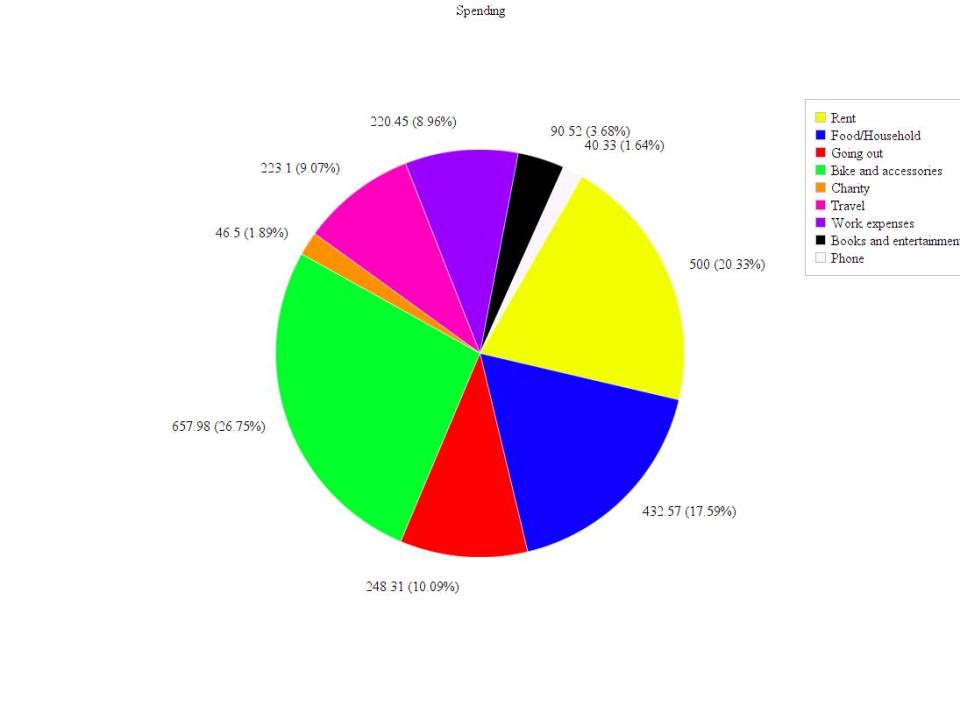

- Rent: £400 (this includes all home bills and is generous, as a couple they could get somewhere cheaper – there is cheap accommodation in London as long as you aren’t too fussy)

- Transport; £0 – cycle to work, gets you fit for free. I’ve done this in London and its fine.

- Food and home: £300 (again generous)

- Entertainment/going out: £200 (very generous)

- Phone contract: £25

- Clothes: £25

Total: £950, leaving them each with £730.05 to save towards a deposit each month. Even just sitting uninvested this will reach £17,521.20 in a year. One year of relatively mild sacrifice (two if you’re single) to get on the London housing ladder!

If this sounds impossible it’s only because you’ve never known anything else. Financial education is almost non existent in UK schools and universities. I and thousands of others are doing this. If you start saving 65% of your take home pay aged 20 you will probably have enough to live on for the rest of your life by 30. Imagine what you could accomplish if you didn’t have to compromise your ideals for money ever again. I wish I had thought and read about this sooner. Again the best resource to find out more is here.

- Its your life, take responsibility

In your 20s you will realise that it’s up to you now. No one is marking the path and doing things for you any more (and if they are that’s not a good sign). I work with lots of young 20 somethings fresh from university and the hardest thing to explain to them is that it is not the company’s responsibility to give them a great career. They think someone, their career coach, line manager or boss, should be presenting them with a series of opportunities for growth and progression exactly tailored to their interests and skills. I don’t blame them, I was the same when I started.

Sadly life is not like that. The people who get what they want are the ones who put in the work and ask for it. No one is going to arrange a great career, find you a life partner and interesting hobbies. You have to do it all and that will mean facing up to the fact that you’re not already perfect. Sometimes you will screw up at work and you’ll need to take the criticism on the chin. You might even need to get fired a couple of times to work out how to be a great employee. You need to practice being a mature, kind partner in a relationship.

I could go on and on about the amount of scapegoating in our culture. Everyone will always tell you how difficult you have it as a young person because of house prices and job insecurity and Facebook messing with your brain and how sorry you should feel for yourself. Resist! Go against the grain of this negativity and chart your own course, become resilient and tough in the face of the minor adversities that life throws at you. The external factors are trivial compared to your response to them.

You will never have more energy and fewer commitments to hold you back from accomplishing something significant than you do now. Make the most of the incredible opportunity your 20s present and most importantly of all – enjoy them, because they will be gone before you know it.